aerogondo

The Industrial Select Sector SPDR Fund ETF (XLI) rose +2.44% in the week ending July 12, while the SPDR S&P 500 Trust ETF (SPY) rose +0.96%.

Joby Aviation topped the list of gainers, while airline-related stocks were among the losers.

The industry was among 10 of 11 S&P 500 sectors to end the week in the green. Year-to-date, or YTD, XLI is up +8.94%while SPY rose sharply +17.82%.

The top five gainers in the industrial sector (stocks with a market capitalization of more than $2 billion) gained more than +14% each this week. YTD, only 2 of these 5 stocks are up.

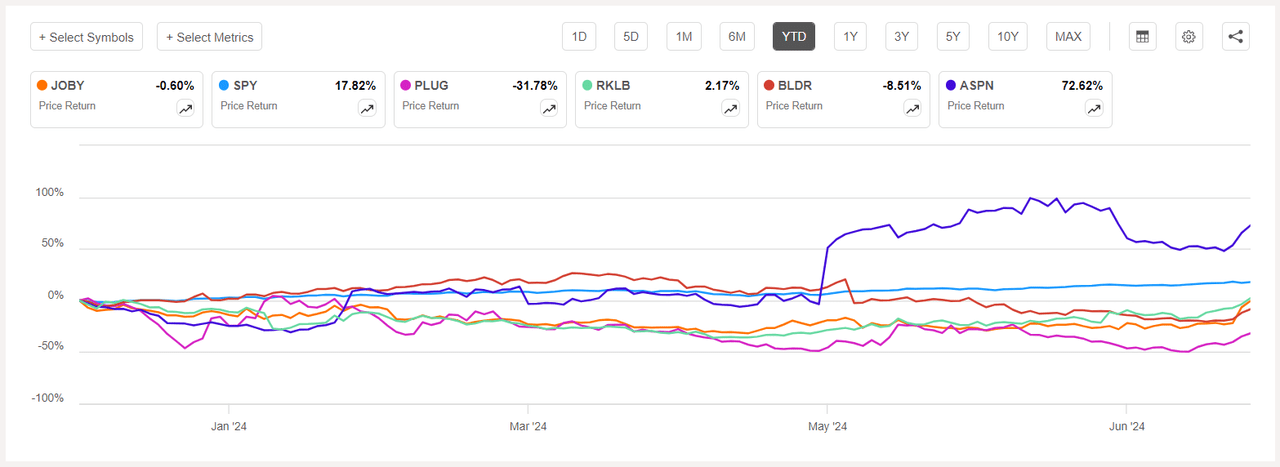

Joby’s Aviation (NYSE:JOB) +28.10%. Shares soared +19.65% on Thursday after the company announced it had successfully flown a first-of-its-kind hydrogen-electric air taxi for 523 miles, with the only byproduct being water. YTD, -0.60%.

JOBY has an SA Quant Rating — which takes into account factors like Momentum, Profitability, and Valuation, among others — of Hold. The stock has a Factor Score of B+ for Profitability and D+ for Growth. The average Wall Street Analysts’ Rating is in agreement and also has a Hold rating, with 3 out of 7 analysts rating the stock as such.

Power plug (PLUG) +18.53%. Shares of the company, which develops hydrogen and fuel cell solutions, were among solar and alternative energy stocks that rose on Thursday (+8.92%) boosted by cooler-than-expected inflation data that raised hopes the Federal Reserve will start cutting interest rates sooner rather than later. YTD, -31.78%.

The SA Quant rating for PLUG is Sell with a score of D- for Momentum and B for Valuation. The average Wall Street Analysts’ Rating differs and has a Hold rating, with 18 of 29 analysts calling the stock a Hold.

The chart below shows the year-over-year price-return performance of the five largest gainers and SPY:

US Rocket Laboratory (RKLB) +15.78%. The space company’s shares have been rising all week. YTD, +2.17%. The SA Quant rating for RKLB is a Hold with a score of B for Growth and B+ for Momentum. The average Wall Street Analysts’ Rating is more positive with a Buy rating, with 7 of 12 analysts labeling the stock a Strong Buy.

FirstSource Builder (BLDR) +15.18%. Shares of building materials manufacturers and distributors also rose Thursday on the low inflation report. Shares of the Irving, Texas-based company rose +7.44% on Thursday. YTD, -8.51%SA Quant’s rating on BLDR is Hold, which contradicts the average Wall Street analyst rating of Buy.

Aspen Aerogels (ASPN) +14.94%Shares of the maker of aerogel insulation products also rose on Thursday (+7.80%). A year so far, +72.62%The SA Quant rating for ASPN is Hold, which differs from the average Wall Street analyst rating of Strong Buy.

The five largest industrial stocks (market capitalization above $2 billion) fell this week with losses exceeding -4% each. YTD, all these 5 stocks are up.

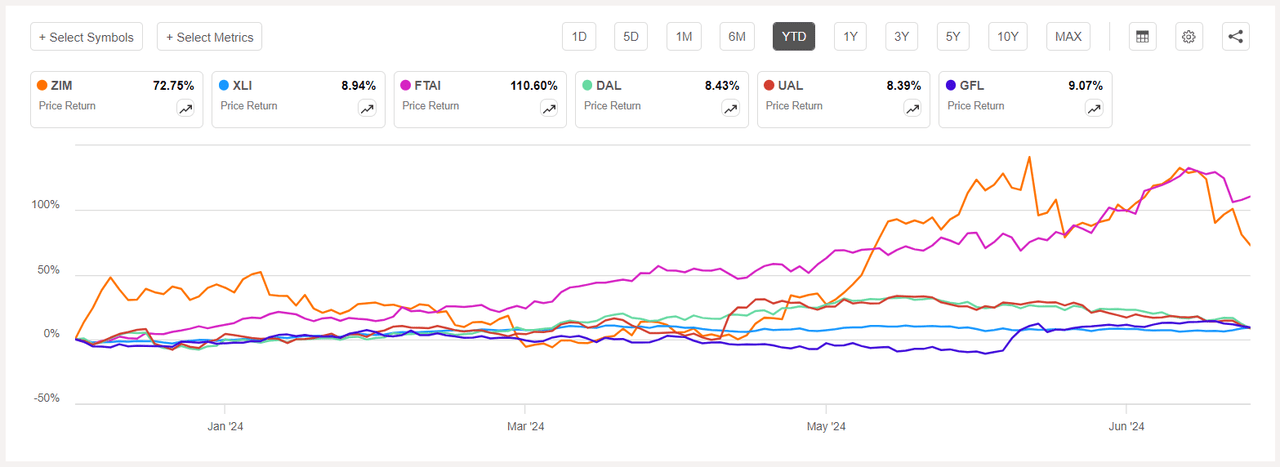

Integrated ZIM shipping services (NYSE:WINTER) -22.89%The shipping company’s shares fell the most on Thursday (-9.88%). A year so far, +72.75%. The SA Quant rating for ZIM is Hold, with a Factor Score of D for Yield and A+ for Momentum. The average Wall Street Analysts’ Rating is in agreement and also has a Hold rating.

FTAI Aviation (FTAI) -7.56%. Shares of the aircraft leasing and engine maintenance company fell -8.23% on Wednesday after Wolfe Research downgraded the stock from Outperform to Peer Perform. YTD, the stock rose sharply +110.60%

FTAI’s SA Quant rating is a Hold, with a score of A- for Growth and F for Valuation. The average Wall Street Analysts’ Rating is a contrast, at Buy, with 6 of 12 analysts calling the stock a Strong Buy.

The chart below shows the year-over-year price-return performance of the five worst-performing stocks and the XLI:

Delta Airlines (DAL) -5.22%. Shares of the Atlanta-based company fell -3.99% on Thursday after second-quarter results missed expectations. Delta also led the airline sector lower after warning of lower fare discounts. YTD, +8.43%.

The SA Quant rating for DAL is Buy, with a Factor Score of A+ for Profitability and B- for Growth. The average Wall Street Analysts’ Rating is also positive at Strong Buy, with 15 out of 21 analysts considering the stock as such.

United Airlines (UAL) -4.85%Shares of the Chicago-based company fell the most on Thursday (-3.20%). Earlier this week, a wheel fell off a Boeing 757-200 operated by United Airlines during takeoff from Los Angeles. Separately, JetBlue has called on the U.S. Department of Transportation to disqualify UAL from providing one of five recent round-trip flights out of Washington Reagan National Airport. YTD, +8.39%.

The SA Quant rating for UAL is a “Strong Buy,” while the average rating from Wall Street analysts is a “Buy.”

GFL Environmental (GFL) -4.27%. Shares of waste management company fall -1.63% on Tuesday after BMO Capital Markets downgraded the stock from Outperform to Market Perform. YTD, +9.07%The SA Quant rating for GFL is a “hold,” while the average rating from Wall Street analysts is a “buy.”