Bitcoin crashed precipitously on July 4 and 5, extending losses from record highs to around 30%. Although it bounced back over the weekend, forcing the world’s most valuable coin up almost 11%, BTC is still in a bearish pattern.

Bitcoin Correction Not Over: Will Bears Break Through $50,000?

One analyst who he took X confirmed this assessment, adding that the optimism of the past 48 hours could be dampened in the coming sessions. Since BTC is not yet secure, at least on a technical level, the analyst predicts that the cryptocurrency will not only fall below last week’s lows, but will likely exceed the psychological $50,000 mark.

Given the historical price fluctuations, the cryptocurrency is predicting that Bitcoin price could fall as low as $48,000 in the coming days, or about 40% from its all-time high.

Once this happens, and following the price movement seen in 2017 when the coin fell 40% after local highs, the coin will resume its uptrend.

Still, looking at the analyst’s assessment, anchoring the swing highs and lows of the Fibonacci retracement tool is subjective. For now, if the September 2023 to March 2024 range behaves like a pendulum and lows, a 40 percent decline from local highs puts the bitcoin price $10,000 lower, to around $37,000.

The weekly chart is starting to crack. After last week’s losses, the coin closed well below its 20-period moving average, giving sellers control. Confirmation of last week’s losses could trigger a modern wave of declines, causing even greater losses in the low term and pushing the price of the world’s most valuable coin up to $50,000 or even $40,000.

How high will BTC rise after the correction?

However, after cooling down and with depth not a factor, another analyst predicts the coin will bounce back strongly. If BTC finds support around $47,000-$50,000, the probability of it rising to at least $102,000 is high.

This is the first level of Fibonacci extension. At its peak, the coin could rise to $242,000 in the coming sessions.

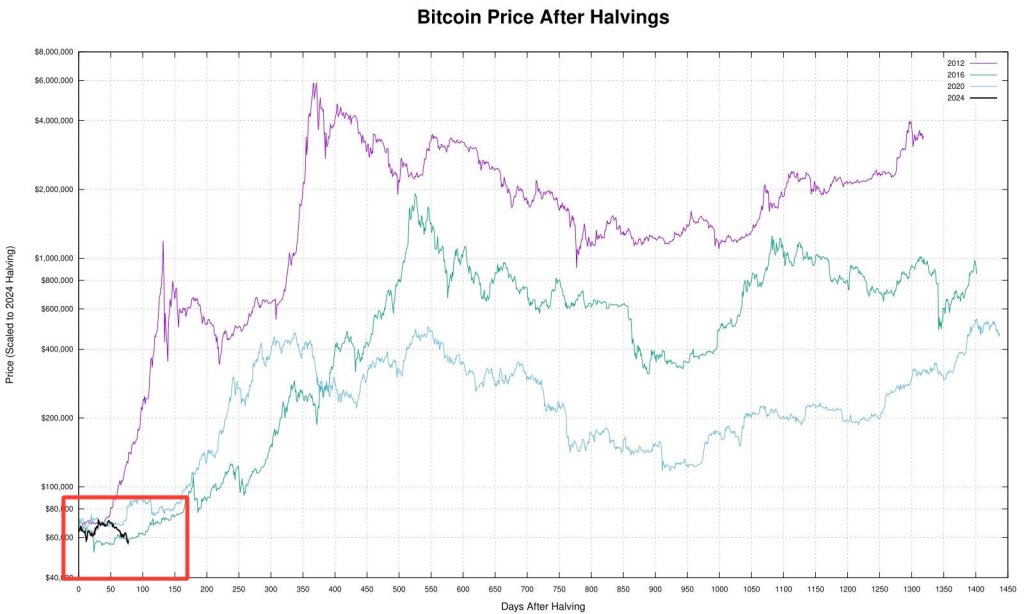

The certainty that BTC will rebound from the current sell-off, primarily caused by fears of the Mt. Gox liquidation and the German government’s continued withdrawal of shares, is based on history. Bitcoin prices tend to recover steadily after the Halving.

If anything, it’s one analyst he said holders should not panic and sell in the first 79 days after the Halving event. Marking the beginning of the fifth era, the network reduced its rewards for miners on April 20, about three months ago.

Featured image from DALLE, chart from TradingView