The winds of change are swirling around Polkadot (DOT)After a month-long slump that mirrored the broader cryptocurrency market crisis, DOT finds itself at a critical juncture.

Technical indicators suggest a bullish turn, with some analysts predicting a significant price escalate for the interoperable blockchain darling. However, the recent buying spree by the Polkadot Foundation has cast doubt on the value, leaving the community divided.

Falling Wedge Points to Breakout, Analysts Eye $9 Target

While technical analysis paints a potentially promising picture, hopes for DOT holders are fading. A “falling wedge” pattern, historically a bullish indicator, is observed on the daily chart. This pattern suggests price squeezing between converging trendlines, often ending with a acute breakout.

Renowned analyst Jonathan Carter has identified $6.50 as a key resistance level. A decisive break above that point could trigger increased buying pressure, driving DOT toward his projected earnings targets of $7.75 and even $9.00.

The dot forms a falling wedge on the daily chart💁♂️

Key resistance at $6.5 – a necessary breakout to maintain the upward structure☝️

Consider setting profit targets at $7.75 and $9.00🎯 photo:twitter.com/OwPVFaPZyD

— Jonathan Carter (@JohncyCrypto) July 3, 2024

The falling wedge pattern and increasing trading volume suggest that a potential breakout is imminent. A successful breakout of the $6.50 resistance could signal a significant change in market sentiment, paving the way for a significant price escalate.

This optimism is fueled by the Relative Strength Index (RSI), which is currently hovering around 48.65. This neutral level indicates that DOT is neither overbought nor oversold, leaving room for further growth.

Polkadot Foundation Shopping Spree

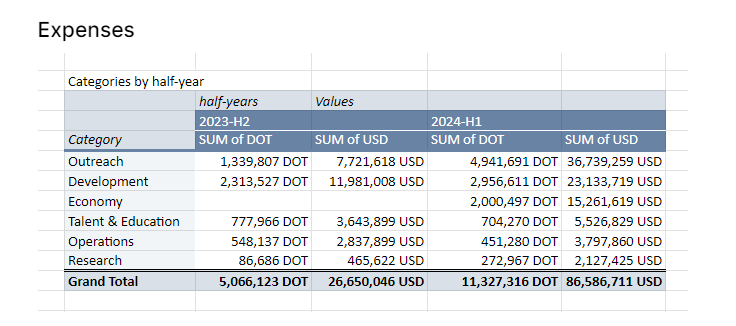

However, the recent spending spree by the Polkadot Foundation has injected a dose of skepticism into the bullish narrative. Earlier this year, the Foundation burned a staggering $87 millionwhich resulted in a significant reduction in the cash balance.

The breakdown reveals that $36.7 million was earmarked for advertising and events, $15 million for marketplace incentives, and $23 million for development. While the foundation maintains that these investments are crucial to increasing the network’s visibility and adoption, community members are not convinced.

Many point out that despite the significant spending, Polkadot still lags behind competitors like Ethereum and Solana in key metrics like network activity, developer engagement, and total value locked (TVL).

The spending seems excessive, especially given the lack of physical results, some community members said on the Polkadot forum. The blockchain needs to get a better return on investment before the foundation spends more money on marketing campaigns, they said.

Will spending concerns scare away investors?

The coming days will be crucial for DOT. If the technical indicators are correct and the price exceeds $6.50, a significant rally could occur.

But community concerns about the Foundation’s spending habits can’t be ignored. If those concerns translate into a broader sell-off, the potential blowout could backfire.

Featured image from Shutterstock, chart from TradingView