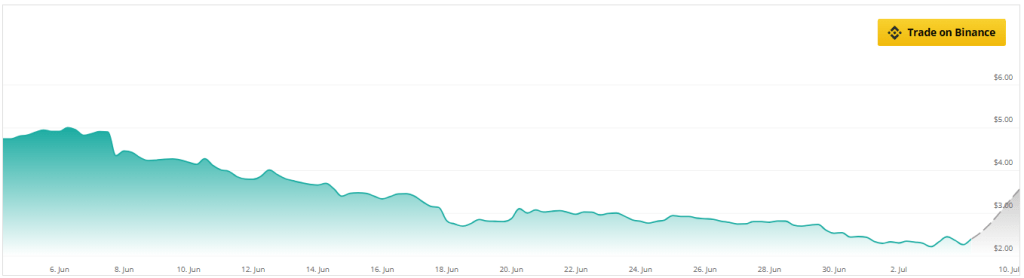

Worldcoin (WLD) has been on a rollercoaster ride over the past few months. After hitting an all-time high of nearly $12 in March, the coin has entered a downward spiral, falling more than 60% in the past three months. This drastic drop has left investors worried, with rumors of regulatory issues and profit-taking circulating around the beleaguered token.

However, the recent price rally suggests a potential comeback story for the token that powers the digital identity app. As of today, WLD is trading at $2.27, a modest but significant augment from its November 2023 lows. This uptrend has analysts cautiously sanguine, but several factors could determine whether WLD bounces back or retraces its steps.

From Gloom to Hope: Changing Moods

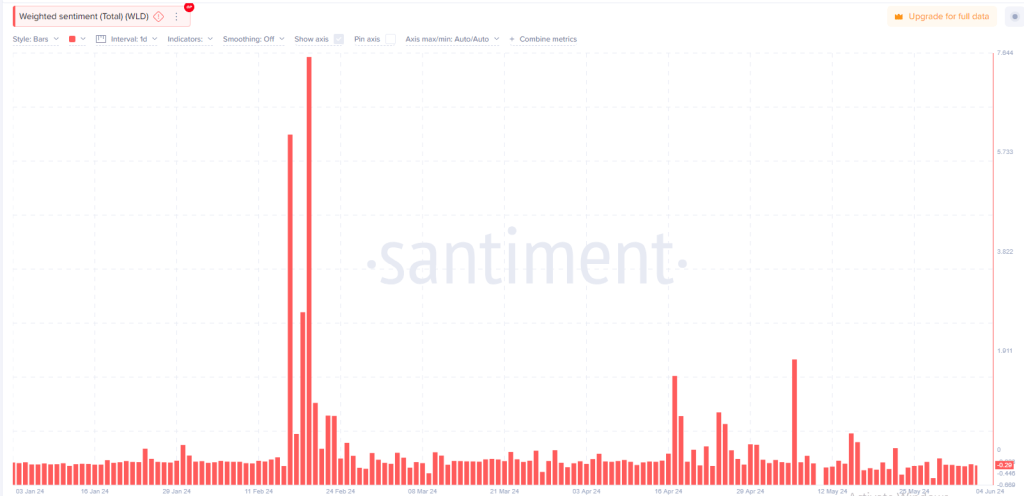

Social Media Attitude around Worldcoin paints a fascinating picture. Just a month ago, negativity dominated the online conversation, with the Weighted Sentiment indicator reflecting a decidedly bleak outlook. This negativity was likely due to the acute price drop, which led many to question the project’s future.

However, there has been a recent change in sentiment. The negativity has dissipated, replaced by cautious optimism. Internet rumors now reflect a wait-and-see approach, with some investors expressing renewed interest in the project. This positive sentiment could prove crucial to a potential revival of WLD. A bullish online community could translate into increased demand for the token, driving its price higher.

This change in sentiment can be attributed to a few factors. First, the recent price augment has undoubtedly boosted morale. When investors see a token breaking out of the abyss, it instills a sense of hope in them and encourages them to hold on to their holdings.

Secondly, an oversold signal from the Relative Strength Index (RSI) could be interpreted as a buying opportunity by experienced traders, further contributing to the positive sentiment.

The bulls are charging, but will they stay the course?

Another intriguing phenomenon is the activity of “whales”, huge investors who can significantly affect the token’s price. According to the Bulls and Bears Indicator, there has been an augment in buying activity by these whales. This suggests renewed confidence in the potential of WLD, and if this buying pressure continues, it could push the token towards the desired $3 level in the low term.

However, there are potential obstacles ahead. The RSI, while currently indicating a robust balance, could return to overbought territory. This would signal a potential correction, where investors who bought at lower prices could cash out, causing a transient decline. Furthermore, if the bulls lose momentum and selling pressure increases, recent gains could be quickly erased.

Worldcoin Price Forecast: Bullish Long-Term Outlook

Looking beyond the immediate future, several price forecasting models offer insight into Long-term prospects for WLD. One such model estimates a 48% gain over the next seven days, potentially taking the price to $3.56. This short-term forecast is based on continued buying pressure and a robust balance between bulls and bears.

The long-term outlook seems even more sanguine, with some analysts predicting a price of $6.41 within a year, a significant augment from current levels. This sanguine view is likely based on the continued development of the Worldcoin identity app and its potential for widespread adoption.

While the future remains uncertain, recent events surrounding WLD provide a glimmer of hope. A positive change in sentiment, increased buying activity, and a potentially bullish long-term outlook paint a cautiously sanguine picture for a token in trouble.

Featured image is from X/@worldcoin, chart is from TradingView