According to Lark Davis, a popular cryptocurrency analyst, the recent decline in the value of Bitcoin (BTC) may be a short-lived slump. Davis predicts a significant augment Bitcoin value in the coming weeks, with a goal of $90,000 by the end of the year. This positive outlook comes amid a wave of optimism around institutional investing and the potential emergence of Bitcoin-based ETFs.

Institutional investors ready to boost the market

Davis believes a surge in institutional money is poised to enter the cryptocurrency market, acting as a major catalyst for the anticipated rally. He points to Standard Chartered Bank’s forecast that Bitcoin will hit a staggering $100,000 by August as a sign of growing institutional confidence. While he offers a slightly more conservative forecast of $90,000, he focuses on the long-term impact of this institutional influx.

The emergence of Bitcoin ETFs is another factor driving Davis’ bullishness. These investment vehicles would allow conventional investors to gain exposure to Bitcoin without having to directly purchase and hold the cryptocurrency. Davis argues that the ease of access offered by ETFs could attract a significant amount of up-to-date capital, further boosting the price of Bitcoin.

Beyond Bitcoin: A Record Year for Altcoins?

Davis’ bullish view extends beyond Bitcoin to a significant portion of the altcoin market. He predicts a significant inflow of capital into Ethereum (ETH) right after the upcoming spot ETFs. Solana (SOL) is another coin on Davis’ radar, whose leadership in blockchain development and market momentum make it a robust contender for growth.

There are still technical obstacles: will the bulls be able to overcome them?

While Davis’s forecast paints a rosy picture, technical indicators suggest that there may be some resistance to overcome before the event begins. The recent price rejection at $63,956 and bearish signals from technical indicators such as the Relative Strength Index (RSI) suggest that there may be some tiny term adversities.

Davis remains positive, however. If Bitcoin breaks through the $72,000 resistance level, a bull run could occur in Q4, potentially sending shockwaves through the entire cryptocurrency market.

Climb or cliffhanger?

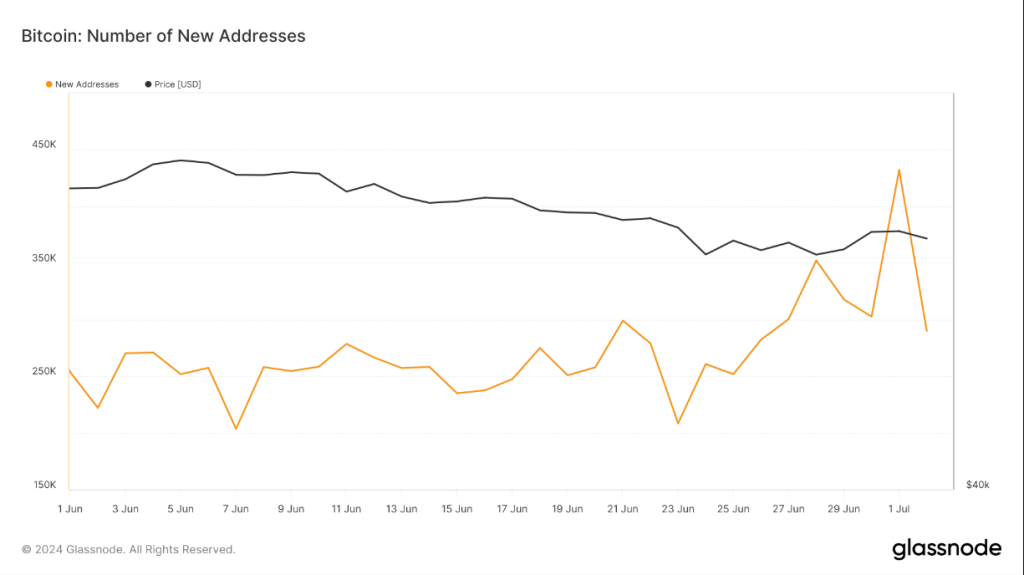

Meanwhile, NewsBTC’s analysis of Glassnode data reveals, augment in the number of up-to-date BTC addresses, potentially indicating an augment in user interest. A daily close above the $63,950 resistance level is key for bulls to move forward. This could trigger a 5% rally and a retest of the weekly resistance of $67,140.

If momentum indicators like the RSI and Awesome Oscillator start rising, an additional 6% rebound to $71,200, the weekly resistance level, is possible.

However, a drop below $58,300 and a lower low could signal a continuing bearish bias, potentially resulting in a 3% decline and a return to the May low of $56,520.

Featured image from Getty Images, chart from TradingView