Bitcoin has been trending higher in spot prices, surpassing $63,000 on June 30 before pulling back. While momentum is picking up, the coin’s price movement is a subject of debate. Still, some have doubts, thinking there’s reason for a possible revaluation.

Analyst: Bitcoin Is Overvalued, Here’s Why

In a post on X, one of the analysts he argues that the coin will likely frigid down, extending the 18% decline recorded in June. In summary, the analyst said the preview took into account several parameters, including time, the number of busy Bitcoin addresses, and the hash rate.

The analyst stated that there was reason to doubt the uptrend with this model, which dampened the sentiment of hopeful holders who expected bulls to press. At the time of writing, Bitcoin has returned to a multi-week range with its market cap at an all-time high and support at $56,800 registered in May.

It’s clear from the price action that buyers are in control, at least from a top-down perspective. Despite the lower lows, especially in May when prices topped $60,000, bulls have a chance from a top-down perspective.

It is worth noting that prices are in the growth zone after the gains in the first quarter of 2024. However, the failure of buyers to confirm gains in mid-March is slowing the uptrend.

Buyers failed to break through $74,000 on the daily chart, with $72,000 being a sturdy liquidation line. In the miniature term, the trend could change if prices break decisively above $66,000, preferably on the back of increasing trading volume.

Germany sells as BTC gains against US M1 money supply

Further fueling concerns is the recent airdrop by the German government. On July 1, they transferred 1,500 BTC, which is over $94 million. Lookonchain data shows that 400 BTC was sent to three exchanges, including Bitstamp.

While it’s not immediately clear if they sold, sending them to an exchange suggests they’re eager to sell them — pure pessimism. An address linked to the German government currently holds more than 44,000 BTC, worth more than $2.5 billion at spot rates.

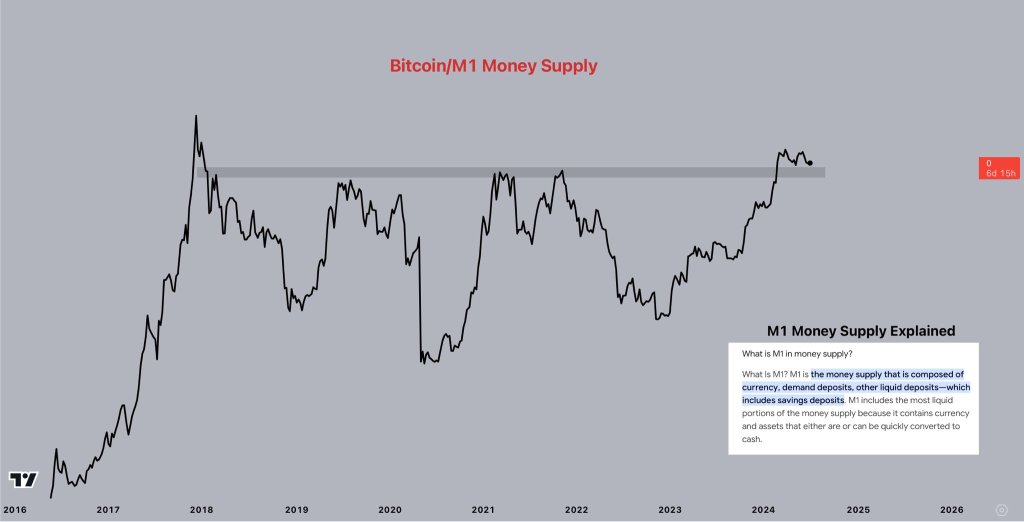

Even amid these concerns, others are bullish on BTC. Citing the relationship between the M1 money supply in the United States and BTC prices, one analyst said the coin is poised for huge gains.

Analyst looking at a chart he argues that bitcoin’s value has not reached a fresh record high relative to the M1 money supply in the United States in over six years.

However, given the steady enhance in BTC prices since mid-2023, it is highly likely that bulls will take control, driving the price of this coin to fresh record highs.

Featured image from DALLE, chart from TradingView