- The EUR/USD pair saw some interest on Thursday, but the growth dynamics remains restricted.

- German labor market data will be released on Friday, impact on the market will be restricted.

- US PCE price index inflation to end the trading week.

EUR/USD found a gaunt bid on Thursday, but the pair continues to trend toward the mid-range near 1.0700 as hesitant bidders shuffle their feet ahead of Friday’s key U.S. inflation print. European economic data was strictly average in the second half of the trading week, which had markets paying attention to US consumer expenditure price index (PCE) inflation, which is expected to appear in the US market window on Friday.

Forex Today: US Inflation Comes to the Forefront… Again

European data weakened moderately on Thursday, with the pan-European economic sentiment index falling to 95.9 from the previous 96.0, missing the forecast enhance to 96.2. Friday’s change in the unemployment rate in Germany is expected to show that there will be 15,000 jobs in June. net fresh jobless benefit claimants, down from the previous 25,000, while the seasonally adjusted June unemployment rate is expected to remain stable at 5.9%.

The number of fresh unemployment claims in the US in the week ended June 21 was better than expected, showing 233,000. net fresh benefit claimants compared to the forecast 236,000, which is a slightly larger decline compared to 238,000 from last week. The four-week average number of jobless claims rose to 236,000, meaning the latest week-over-week result is again below the rolling average.

U.S. gross domestic product (GDP) met expectations on Thursday, with first-quarter GDP slightly revised up to 1.4% from an initial 1.3%. Core consumer spending also rose slightly in the first quarter, rising 3.7% q/q versus a forecast of 3.6%. Thursday’s presidential debate, set to begin after the market close, will draw attention as investors look for possible policy cues from the candidates.

Friday’s U.S. PCE price index inflation print will be the key data indicator of the week as investors count on a further cooling in U.S. inflation rates, which will aid the Federal Reserve (Fed) move closer to interest rate cuts. With the current cut, core PCE price index inflation is forecast to fall to 0.1% m/m in May from 0.2%.

Economic indicator

Basic personal consumption expenditure – price index (m/m)

Core personal consumption expenditure (PCE) published by US Bureau of Economic Analysis on a monthly basis measures the price changes for goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred measure of inflation. MoM data compares commodity prices in a reference month with the previous month. The core reading excludes the more volatile components of food and energy to provide a more correct measure of price pressures. Generally speaking, a high reading is bullish for the US dollar (USD), while a low reading is bearish.

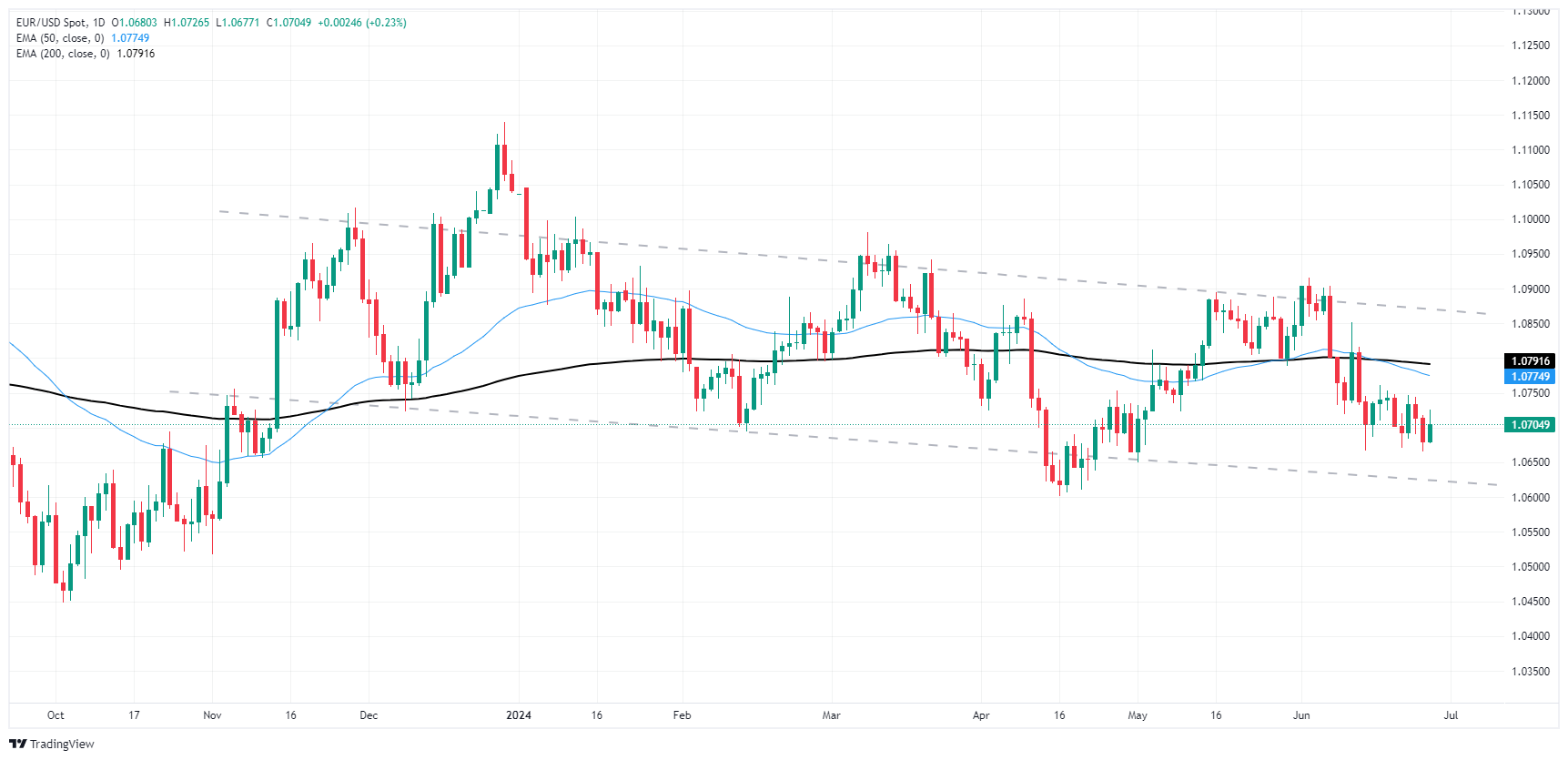

Technical Outlook for EUR/USD

Fiber caught Thursday’s bid as the pair bounced from the demand zone priced below 1.0680, returning to the 200-hour exponential moving average (EMA) of 1.0717 before returning to the 1.0700 level ahead of Friday’s market session.

The EUR/USD pair is trapped in a holdup on the daily candles, drifting towards the lower end of a tough descending channel, while the pair is hovering on the bearish side of the 200-day exponential moving average (EMA) at 1.0785.