Binance Coin (BNB), the native token of the world’s largest cryptocurrency exchange Binance, has been in crisis in recent weeks. After emerging from a period of consolidation, BNB skyrocketed to a up-to-date record high of $717 on Friday. Despite the minor correction, the coin remains firmly in bullish territory, with analysts predicting further growth potential.

Increased demand for fuels

A confluence of factors appear to be driving this newfound buying pressure. Increased user engagement on the Binance exchange, combined with the growing utility of BNB in its ecosystem (discounts on transaction fees, participation in token sales), has likely increased demand for the coin. Additionally, positive sentiment in the cryptocurrency market undoubtedly played a role.

Technical indicators flash green

Technical analysis also paints an bullish picture for BNB. Momentum indicators such as the Relative Strength Index (RSI) and the Money Flow Index (MFI) are currently in overbought territory, suggesting buying activity is outpacing selling activity. This indicates powerful market strength and potential for further price appreciation.

Eyes on $750 and up

Analysts are cautiously bullish about BNB’s future trajectory. If the current buying pressure continues, some predict that BNB could hit $750 in the near future. This price target represents a potential uptrend from current levels.

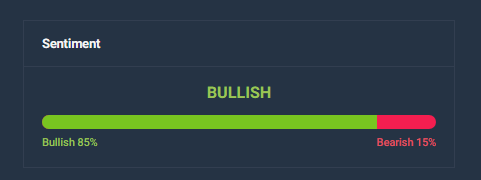

Meanwhile, Binance Coin (BNB) is expected to see a significant augment of 145% in value, potentially reaching $780 by July 7, 2024. bullish forecast supported by powerful technical indicators and the current market sentiment is bullish. The Fear and Greed Index, currently at 77, indicates a state of extreme greed, suggesting increased investor confidence and a solid buying environment.

Featured image from Bit Perfect Solutions, chart from TradingView