Bitcoin traders are upbeat, confident that bulls have more legs to push prices above $72,000, an all-time high. While the excitement for what lies ahead is primarily driven by the massive inflow into spot Bitcoin ETFs, Charles Edwards, founder of Capriole Investments, has picked out a number of factors limiting the current uptrend to $100,000.

Here’s why Bitcoin is still trading below $100,000

In the X post, Edwards he said Several factors combine to suppress profits. But most of them involve a conflict between up-to-date institutional money and a wave of selling by long-term holders.

Roughly six months after the first batch of cash Bitcoin ETFs were approved by the U.S. Securities and Exchange Commission (SEC), billions continue to flow into these derivative products.

All nine spot BTC ETF issuers in the United States, according to Lookonchain added On June 6, 6,907 BTC worth over $492 million. Fidelity added 3,104 BTC and BlackRock bought 2,186 BTC.

Encouragingly, after the May 20 surge, institutions are increasingly buying more BTC, gaining exposure through spot ETFs.

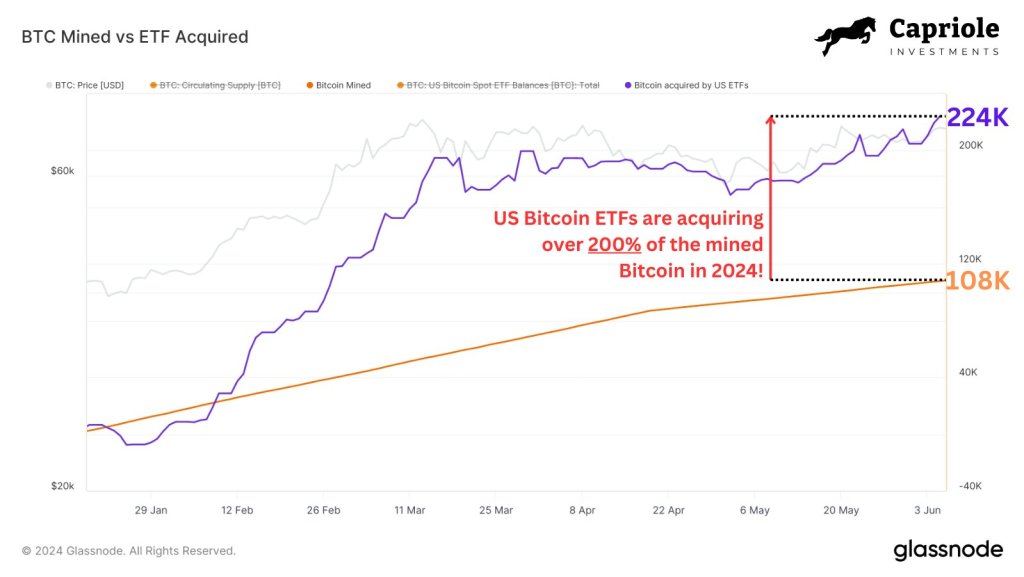

Edwards notes that spot Bitcoin ETF issuers in the United States have been aggressively accumulating their shares over the past six months. So far, they have purchased 200% of all BTC mined since their January debut.

This means that there is a steady and impressive stream of institutional investment flowing into Bitcoin. In response to this development, BTC prices are trending upwards, surpassing 2021 highs and printing up-to-date all-time highs in March 2024.

While the upward trend is clear, the pace of expansion is discouraging. Edwards notes that more and more long-term holders are actively selling. Their share of the total supply declines from its December 2023 peak of 57% to 54%, reducing 630,000 BTC in the process. This number dwarfs the total holdings of all BTC accumulated by issuers of cash Bitcoin ETFs in the United States.

Bitcoin cash ETF inflows, USD liquidity, and long-term holder retention are key

Amid this expectation, the founder believes that Bitcoin can still break above the local resistance and rise to $100,000. For this level to be tested, there needs to be a surge in institutional appetite for BTC, even driving daily purchases to over $1 billion.

Additionally, long-term holders must sluggish liquidation by limiting supply. If this prints as the US M2 money supply increases, the coin could exceed expectations by breaking out of its current range.

Feature image from DALLE, chart from TradingView