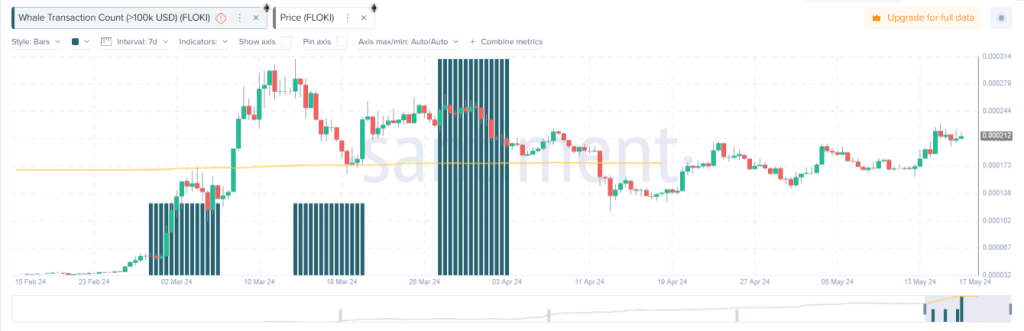

Floki Inu (FLOKI), a Shiba Inu-inspired memecoin, has been in the spotlight with an escalate in trading activity and a nearly 20% price escalate in the past week. Experts warn, however, that this “popularity” may be short-lived and driven more by media hype than by mighty foundations.

Open interest is gaining momentum: newcomers are flocking to FLOKI

The key indicator evoking emotions is the rapidly growing interest in futures contracts for FLOKA. This figure, which reflects the number of outstanding futures contracts, has increased a staggering 110% since May 1, reaching a 30-day high of almost $20 million, according to Coinglass. This suggests an escalate in the number of modern market participants entering FLOKI positions, potentially predicting further price increases.

Adding fuel to the fire is a significant escalate in FLOKA’s daily trading volume. May 15 this year Saintly reported daily volume of more than $1 billion, the highest level for FLOKA since delayed March. This intense buying activity indicates increased investor interest, pushing the price up.

Momentum indicators point to a bullish charge

An additional argument for the bullish FLOKI is the behavior of its key dynamics indicators. Both the Relative Strength Index (RSI) and the Money Flow Index (MFI) are currently well above the neutral lines at 62.68 and 65.37, respectively. Put simply, these indicators suggest that price dynamics are headed towards further increases in the tiny term.

But beneath the shiny exterior lies potential cause for concern. Chaikin Cash Flow (CMF), an indicator that measures the buying and selling pressure of assets, paints a rather bearish picture.

Still in the negative zone

Despite the price appreciation, FLOKI’s CMF remains strongly negative and currently oscillates around -0.11. This suggests that while the price is rising, buying pressure may be waning.

This divergence between price and buying pressure is often seen as a sign of a potential trend reversal, indicating growth driven by short-term speculation rather than long-term investor confidence.

While FLOKI’s recent performance is undeniably impressive, the underlying factors suggest a potentially volatile future. An escalate in open interest and trading volume indicates a frenzy in the market, but a negative CMF raises concerns about the sustainability of the growth.

Featured image from Floki, chart from TradingView