Drazen_/E+ via Getty Images

UBS has published a list of companies it believes will benefit from the AI boom, with global AI revenue expected to reach $400 billion over the next three years.

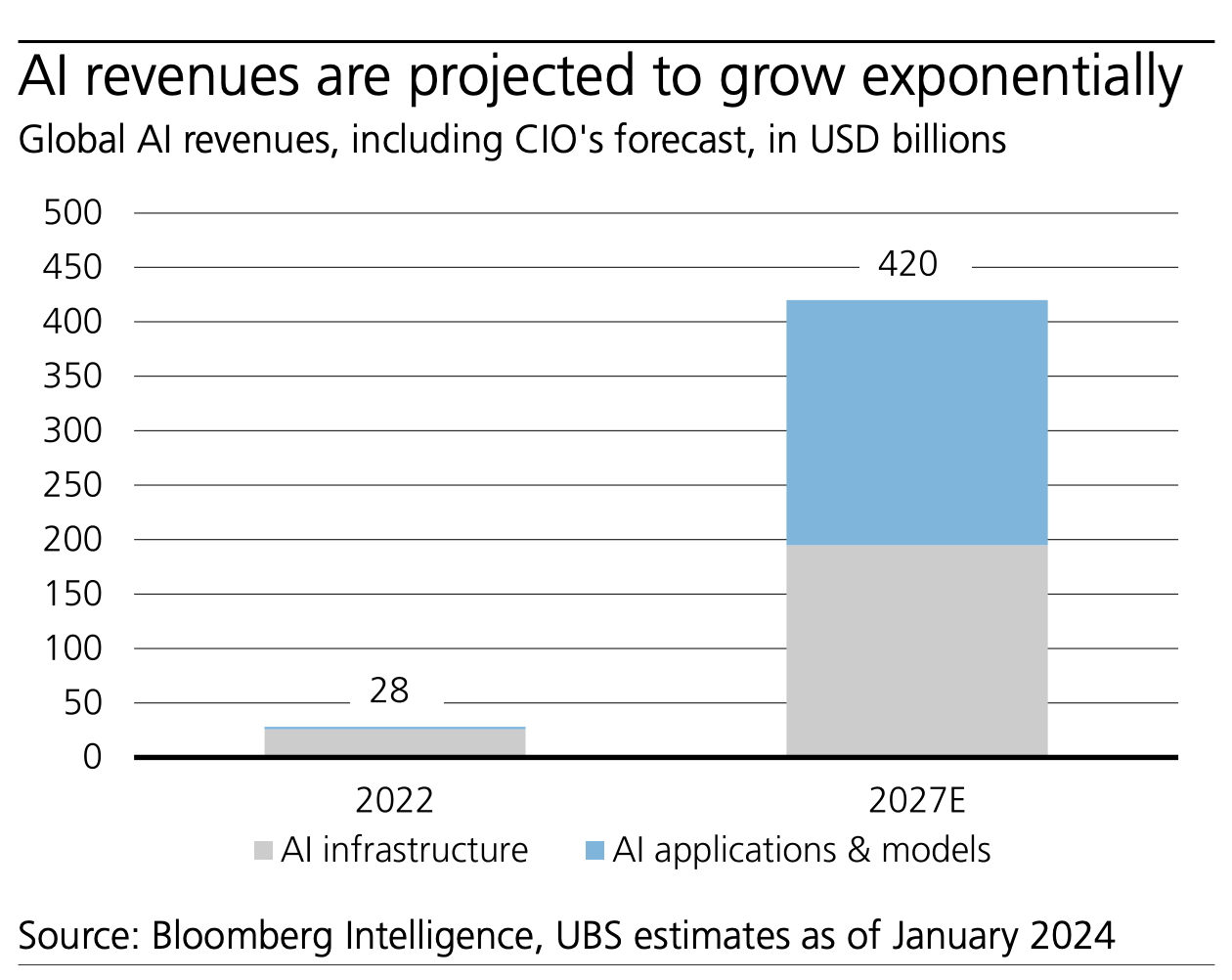

The brokerage advised investors to gain exposure to the companies AI value chain including semiconductors, internet and data centers. UBS forecasts that global AI revenues will reach $420 billion in 2027, up fifteenfold from $28 billion in 2022.

It also forecast that infrastructure spending, driven by GPU cloud and other emerging trends, will reach $195 billion in 2027 from $25.8 billion in 2022.

With around 5% of companies using generative AI, AI adoption has been modest so far. “However, we expect monetization to grow and to account for much of the overall AI growth over the long term,” Nadia Lovell, senior U.S. equity strategist at UBS Global Wealth Management, said Wednesday in a monthly update update on tactical capital issues in the US.

UBS said its list aims to position development of artificial intelligence infrastructure in the near term and greater opportunities in the medium term in software and services.

Here is the list of AI stocks (the “+” sign indicates stocks covered by UBS Global Research):

- Accenture (ACN)

- Adobe (ADBE)

- AMD (AMD)

- Constellation Energy Corporation (CEG)

- Salesforce (CRM)

- Digital Reality (DLR)

- Equinox (EQIX)

- Johnson Control (JCI)

- Metaplatforms (META)

- Microsoft (MSFT)

- Micron (MU)

- NextEra Energy (NEE)

- Nutanix (NTNX)

- Nvidia (NVDA)

- nVent Electric (NVT)

- Oracle (ORCL)

- Palo Alto Networks (PANW)

- Pure Storage (PSTG)

- Seagate Technology (STX)+

- Taiwan Semiconductor (TSM)+

- Trane Technologies (TT)+

- Vista (VST)

- Working day (MIDDLE)

Among ETFs with exposure to AI:

- iShares American ETF (IYW)

- Fidelity MSCI Information Technology Index (FTEC)

- First Trust Dow Jones Internet Index Fund (FDN)

- iShares Global Tech ETF Equity (IXN)

- iShares Expanded Technology ETF (IGM)